Executive Summary

Commercial mortgage loans (CMLs) secured by first liens on high quality, commercial and multifamily properties have long been an important investment class for many institutional portfolio investors. These private investments combine a unique blend of characteristics that can provide complementary benefits and meaningful relative value to a multi-asset investment portfolio.

As insurance companies search for the appropriate combination of yield and performance in the current rate environment, CMLs should be considered as an ongoing component of a broader investment strategy. Potential benefits of CMLs include:

- Compelling relative value

- High recovery rates and commensurate credit loss experience

- Competitive risk-based capital treatment

- Beneficial asset class diversification

- Spread premium results in enhanced current income

- Excellent call protection

- Ability to tailor the portfolio to meet specific needs

Although considerable benefits exist, there are inherent challenges related to investing in CMLs, including:

- Not publicly rated

- Although a secondary market exists, the investments may not be as liquid as other investment classes

- Procuring and managing is more intensive, and requires specialized knowledge and systems

Description and Process

Commercial mortgage loans are fixed income investments that derive their cash flow from the rental income being generated from real estate. As a result, several financial and real estate factors must be assessed when evaluating new investment opportunities or when managing these investments post-funding.

An individual CML is usually secured by a first lien on a commercial real estate asset. Typical property types are industrial warehouses, offices, multifamily apartments, self-storage projects, or retail shopping centers. Individually negotiated CMLs can be tailored to suit the specific needs of various portfolio and underwriting criteria of a lender as well as the needs of a borrower. The procurement process requires rigorous due diligence and underwriting before any loan can be funded. Appropriate due diligence includes financial analysis of the prospects for the property and the borrower/owner, as well as various third-party reports, including appraisals, environmental reports, engineering reports and other reviews related to insurance coverage, zoning, title, etc. The underwriting criteria, loan-to-value (LTV), debt-service coverage ratios (DSCR) and net operating income (NOI) are critical, but other important metrics are evaluated, depending on the type of property, including the associated micro and macro-economic environment, and its specific location.

These investment opportunities are typically sourced through mortgage banking firms, which are engaged and paid by the actual owners of the real estate properties to assist in sourcing appropriate providers of real estate capital. It is through this national system of mortgage bankers and brokers that a well-diversified CML portfolio can be designed and constructed.

Even though CMLs have similarities to other fixed income investments, they also have unique structural features that provide additional benefits. These unique features can provide enhanced structural protections and ultimately reduce losses in a default scenario. With CMLs, investors usually have (i) a first lien on a real property and more latitude with their approach to servicing issues and (ii) more control over the specific approach to various post-closing issues.

Another relevant feature of CMLs for insurance company investors is their accounting treatment. Commercial mortgage loans are reported on insurance company balance sheets at amortized cost for both Statutory (STAT) and GAAP accounting. Under GAAP accounting, many insurance companies establish a general reserve for mortgage losses, with a specific reserve established under both STAT and GAAP accounting if an impairment is deemed likely. The current market values of mortgage loans are provided as a footnote to required regulatory filings. The following table provides a further comparison between CMLs and public corporate bonds.

Structural Comparison: Public Corporate Bonds versus CMLs

| Public Corporate Bonds | Commercial Mortgage Loans | |

|---|---|---|

| Underlying Collateral | Debt obligations of issuer with unsecured claim on corporate assets | A hard asset, commercial real estate property |

| Repayment terms | Semi-annual interest payments, balloon at maturity | Typically fixed principal and interest payments monthly with balloon at maturity |

| Prepayment protection | Unless callable, typically a make-whole provision to Treasuries | Typically closed for a portion of the term, then a make-whole to Treasuries |

| Publicly rated | Yes | No |

| Recourse | To issuer | Typically, non-recourse except for certain actions which are guaranteed by a related person or entity |

| Additional Debt | Limited by bond covenants | Limited by loan documents |

| Liquidity | Very active and liquid secondary market | Secondary loan market, but not as robust |

| Sources of cash flow to meet debt service | General cash flow from issuer | Rental income generated from real estate |

| Ongoing credit monitoring | Quarterly financial disclosures | Quarterly or yearly operating statements and rent rolls for the property |

| Accounting Treatment for Life Companies | Reported at amortized cost for STAT, held at market value for GAAP accounting | Reported at amortized cost for both STAT and GAAP, with current market values listed as a footnote for regulatory filings |

Structural Comparison: Public Corporate Bonds versus CMLs

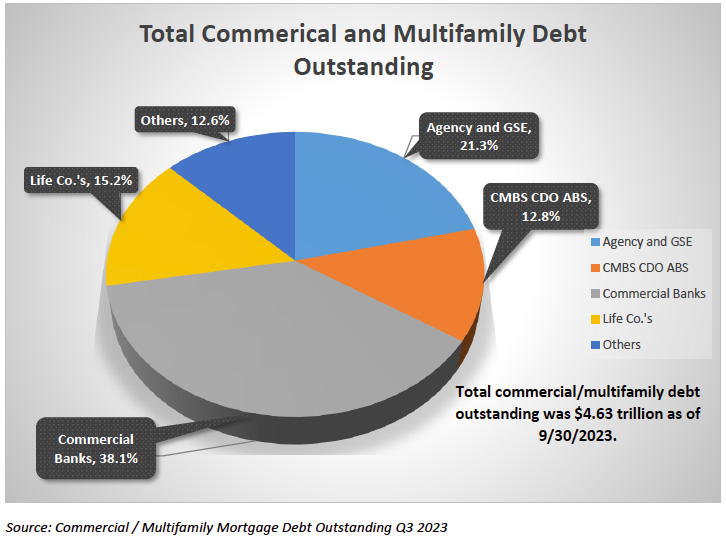

As of September 30, 2023, the Mortgage Bankers Association reported total commercial/multifamily debt outstanding of $4.63 trillion. The four major investor group participants were:

- Commercial banks (38.1%)

- Commercial mortgage-backed securities (CMBS), collateralized debt obligation (CDO) and other asset backed securities (ABS) issues (12.8%)

- Federal agency and government sponsored enterprise (GSE) portfolios (21.3%), and

- Life insurance companies (15.2%)

The $704 billion of commercial and multifamily debt held in life insurance company portfolios validates both the importance of commercial and multifamily loans as an investment class and the significant role insurance companies play in the overall real estate finance industry.

Insurance Company Participation in Commercial Mortgage Loans

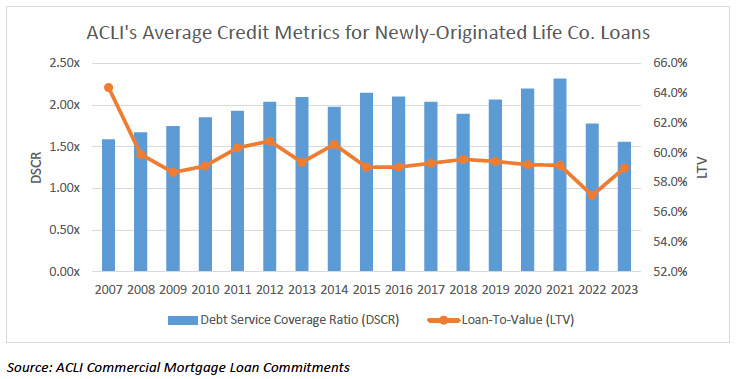

Insurance company lending programs normally target institutional-quality, well-leased properties in major metropolitan areas at moderate levels of leverage. As a result of that conservative investment strategy, insurance companies tend to have the lowest delinquency rates, defaults, and losses within the real estate finance industry. American Council of Life Insurers (ACLI) data supporting the high-quality makeup of insurance company portfolios is demonstrated by two common measures of commercial mortgage risk metrics: loan-to-value (LTV) and debt service coverage ratios (DSCR). The ACLI average credit metrics for newly originated loans for the years 2007 through 2023 were 63% LTV and 1.82 DSCR. For the full year 2023, the averages for those metrics were 58.7% LTV and 1.56 DSCR.

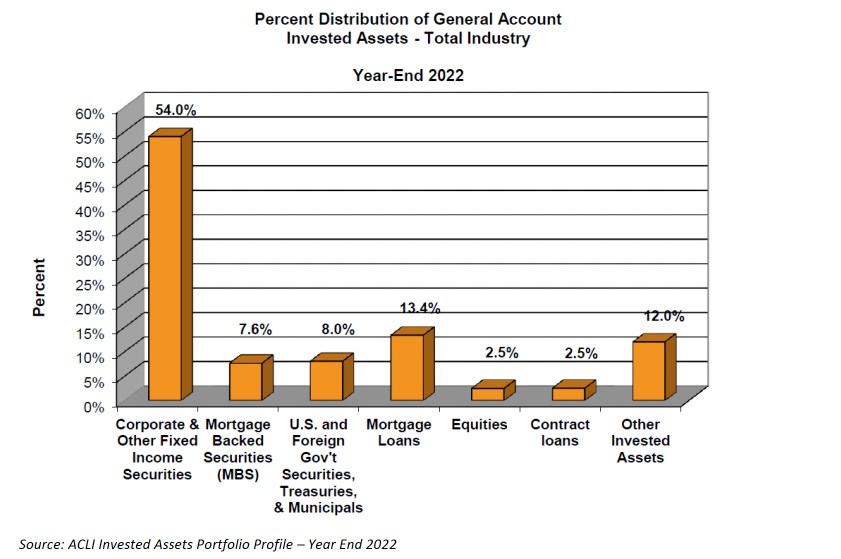

As a result of its various benefits, many insurance companies include CMLs in their multi-asset investment mix. According to the most recent information available from the ACLI, on average, CMLs represent 13.4% of the invested general account assets for the life insurance industry. A few major life insurance companies hold an even greater weighting in CMLs, with percentage exposures in the mid-to-upper teens.

Pricing and Historical Performance of Commercial Mortgage Loans

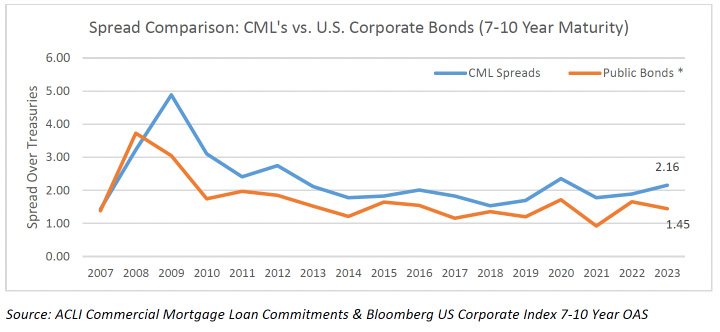

Commercial mortgage loans have historically provided yields greater than comparable quality public corporate bonds. The ACLI tracks insurance company reads above treasuries for new loan originations. The historical ACLI spreads were compared to a composite of similar duration investment-grade corporate bonds from 2007 through 2023. Over that period, CMLs have delivered yields that were on average 57 basis points above this corporate bond benchmark.

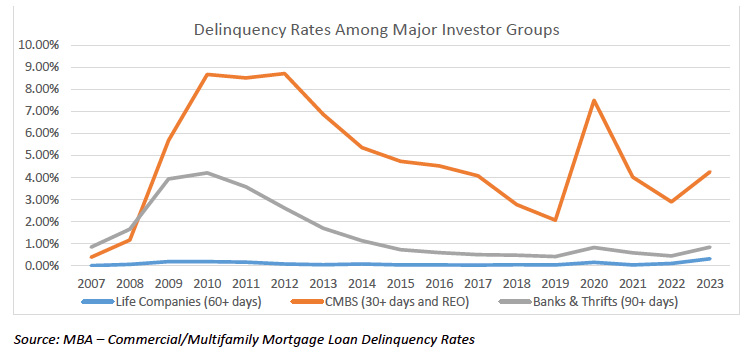

Another important measure of CML performance is historical delinquency rates. The exhibit below graphs life company CML portfolios against the loan portfolios of two other major investor groups, CMBS and banks & thrifts. Although the various reporting measures of delinquency between investor groups vary somewhat and, thus, prevent a direct comparison, the graph does demonstrate the low level of insurance company delinquencies and excellent historical performance of CMLs that were generated and held by insurance companies.

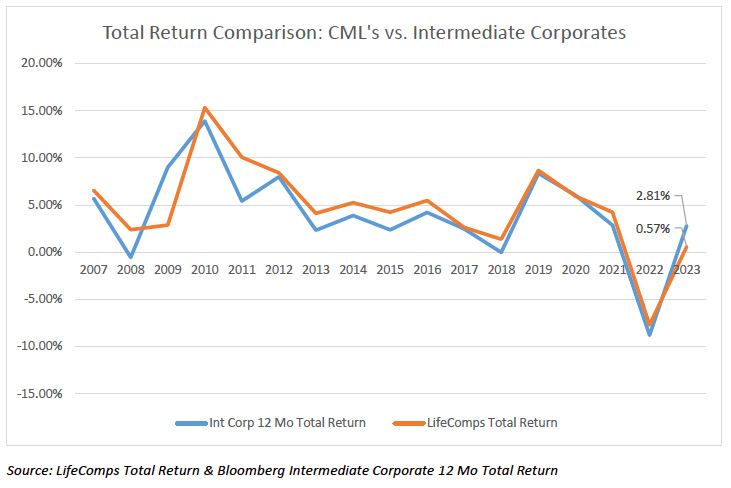

Because CMLs are private, non-rated investments, historical performance has traditionally been difficult to measure. However, in an effort to address this issue, a number of major life companies created the LifeComps Commercial Mortgage Loan Index in 1997. The index tracks actual historic returns, including total return, cash yields, underlying real estate collateral operating performance, and basis point loss. The LifeComps data included are reproduced from the LifeComps Commercial Mortgage Loan Index with the permission of LifeComps. This index serves as a performance benchmark for insurance company whole loan portfolios and is the basis for the mortgage loan component of the investment class performance comparison versus intermediate Investment grade corporate bonds. For this comparison the intermediate bond index was selected because it has a nearly identical duration as does the LifeComps index. As detailed below, over the 17-year period from 2007 through 2023 the Average Total Return for CML’s compared very favorably, with an average total return of 4.73% for CML’s versus 4.00% for intermediate bonds.

Tailoring to Meet Investor Needs

Commercial mortgage loan investments allow the investor to exert considerable control over both specific CML investments and the broader makeup of the mortgage portfolio. Insurance companies typically (i) include amortization of principal throughout the loan term, (ii) do not normally allow the loan to be paid off in the early years, and (iii) require yield maintenance protection in the latter portion of the term. Clauses in the loan documents also prevent the transfer of real estate ownership without lender approval, do not allow additional debt to be placed on the real estate collateral, and provide some level of control over future leasing parameters. These structural issues combined with the nature of the real estate collateral allow better control and allow for direct negotiation with the borrower should a problem arise after the CML is funded. These features should ultimately provide for higher rates of recovery than other asset classes without these features.

Many insurance companies construct their portfolios to match their company’s liabilities to policy holders. The terms of the CMLs typically range between 3 and 20 years, so they are ideal for asset-liability matching for both shorter- and longer-term liabilities. Another beneficial feature is the call protection embedded in the loan documents. Although there is a relatively high degree of correlation with other fixed income investments, CMLs are not perfectly correlated and do add a degree of diversification to a mixed asset portfolio.

Risk Based Capital Treatment (RBC)

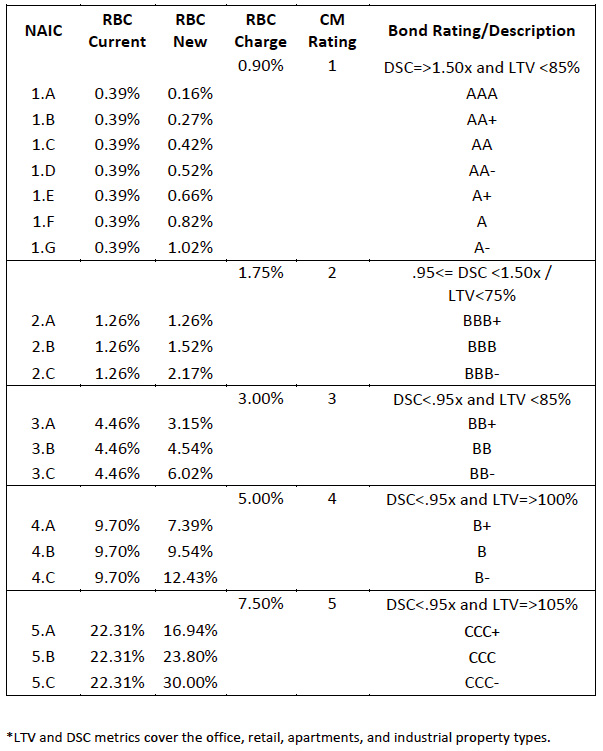

Because CMLs are unrated and somewhat unique investments, there is a distinct process for assessing the risk and assigning risk-based capital requirements to CML investments. In 2013, the National Association of Insurance Commissioners (NAIC) authorized a new risk-based capital methodology that focused more on the metrics of each loan and less on the overall historical performance of an insurance company’s mortgage portfolio. This updated NAIC process was developed using Moody’s analytics and a vast amount of historical data from the insurance company industry. As a result of this analysis, the strong historical performance of insurance industry mortgage portfolios was analyzed, and the resulting overall required capital was actually lowered for the insurance company industry. A 2023 analysis by Fitch indicated that life insurers’ portfolios are largely comprised of high-quality loans, with 90% of CMLs rated CM1 or CM2 on an NAIC basis, which are the NAIC’s two highest mortgage rating categories.

The required RBC charges for both NAIC rated corporate bonds and CMLs – based upon the current rating methodology – is outlined in the following chart. Almost all new first mortgage commercial loans generated by insurance companies for their portfolios are rated either CM1 or CM2. A CM1 loan has an assigned base capital reserve charge of 0.90% and a CM2 requires a capital reserve of 1.75%. These mortgage charges are similar to capital charges that are assigned for NAIC 1 and NAIC 2 rated public corporate bonds, which range between 0.16 to 1.02% for an NAIC 1 and 1.26 to 2.17% for an NAIC 2.

Conclusion

Commercial mortgage loans are a unique, private asset class that can provide compelling benefits and worthwhile relative value to institutional investors. Many insurance companies consider CMLs to be a core component of their investment strategy and are currently a highly favored investment class by many companies. However, the nuances specific to mortgages and the specialized knowledge and systems that are required to underwrite and manage CMLs require the involvement of a capable investment manager.

A meaningful allocation to CMLs affords insurance companies the opportunity to improve their investment results, and if not already active in this investment class, should be seriously considered. A whole loan portfolio can be designed to meet specific needs and allocated to meet duration, risk, and yield requirements.

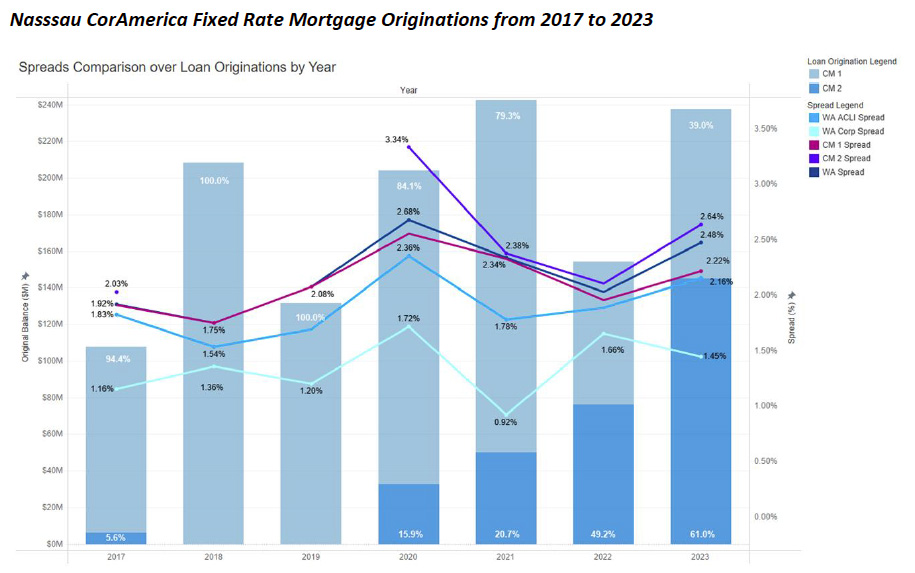

Nassau CorAmerica is a real estate investment management firm that, we believe, has the requisite capabilities and experience to deliver superior results to our existing or new clients, and we would welcome the opportunity to discuss an appropriate investment program for your needs.

IMPORTANT DISCLOSURES

The information set forth herein (this “Presentation”) is being provided by Nassau CorAmerica LLC (“Nassau CorAmerica”) solely for informational purposes only and does not constitute an offer, or a solicitation of an offer, to buy any securities or other investment instrument, or otherwise to participate in any strategy, nor should this Presentation be relied upon to form the basis of any contract or investment decision. Nothing herein constitutes investment advice. You should not construe any of the information contained herein as business, financial, legal, regulatory, tax, accounting or other advice.

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. There is no guarantee that any strategy described herein will or can be successful, particularly in periods of extreme volatility, and investors could lose some or all of their investment.

The information set forth in this Presentation is derived from various sources which Nassau CorAmerica believes, but cannot guarantee, to be accurate as of the date hereof. The information set forth in this Presentation is as of the date hereof, and while Nassau CorAmerica reserves the right to modify or update this Presentation in whole or in part at any time, it is under no obligation to do so. This Presentation may not be reproduced, shared, or distributed to others without prior consent.

Nassau News

Nassau News